Resources

Debt Collection Proposed Rule Comment Letter

September 18, 2019

OPENING PARAGRAPH: Re: Comment from Texas Appleseed regarding notice of proposed rulemaking for debt collection, Docket No. CFPB-2019-0022 or RIN 3170-AA41.

Dear Director Kraninger, Texas Appleseed is a public interest justice center working to change unjust laws and policies that prevent Texans from realizing their full potential. Working with pro bono partners and collaborators, Texas Appleseed develops and advocates for innovative and practical solutions to complex issues. As part of its work, Texas Appleseed also conducts data-driven research to better understand inequities and identify solutions for concrete, lasting change. Texas Appleseed is part of a non-profit network of 17 justice centers in the United States and Mexico. Through its Fair Financial Services Project, Texas Appleseed is a state leader in advocating for fair market practices across many financial services areas, including payday and auto title lending, protections for victims of financial abuse, and in support of fair debt collection practices. We appreciate the effort put in by the CFPB in drafting an expansive proposed debt collection rule, but have deep concerns that certain provisions will lead to market outcomes that go counter to the consumer protection mission of the CFPB and to the letter and intent of the Fair Debt Collections Practices Act. We are particularly concerned about four provisions in the proposed rule. We are concerned about provisions in the proposed rule that:

Debt Collection: Defendant's Answer Form

October 13, 2017

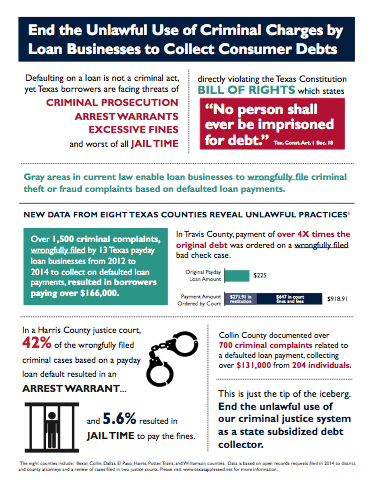

Collection Texas-Style: An Analysis of Consumer Collection Practices in and out of the Courts

June 1, 2016

Featured in the Hastings Law Journal Vol. 67. By Mary Spector and Ann Baddour. Opening paragraph: As many as forty-four percent of Texans with credit files have nonmortgage debt in collection; this is more than ten percent above the national average. The Authors provide a snapshot of collection practices employed in Texas over a two-year period following the

enactment of new court rules governing the litigation of most collection cases. Using a combination of quantitative and qualitative methods, they consider data in three general categories: (1) consumer complaints to the state and federal agencies; (2) court outcomes over a two-year period along with related demographic data; and (3) court observations conducted in five counties with a review of the websites for each of the courts within those counties. The Authors find that for many Texans, consumer debt collection means threats and intimidation that disrupt their family and work lives. While they also found that the default judgment rate in consumer collection cases was slightly lower than reported in a previous study, they found that it appears to be growing, signaling that more work remains to be done. The Authors recommend a number of reform efforts that include steps to increase the quantity and quality of information provided to consumers at all stages of the collection process and to increase enforcement of existing protections. To the extent that court proceedings remain an integral part of that process, the Authors also recommend further standardization of court procedures to ensure only valid claims are raised. They also encourage courts to actively participate in efforts to ensure that the protection of consumer rights does not stop at the courthouse door.

Criminal Discovery

Immigrant Children & Families

Mental Health

Debt Collection

Disaster Recovery & Fair Housing

Education Justice

Fair Financial Services

Fines & Fees

Foster Care & Courts

Homeless Youth

Insurance

Juvenile Justice

Other Issues

Payday & Auto Title Lending Reform

Protecting Seniors from Financial Abuse

Bail Reform & Pretrial Justice

Civil Asset Forfeiture

Coerced Debt

Criminal Justice